Affiliation:

Faculty of Medicine, University of Porto, 4200-319 Porto, Portugal

Email: enzofaversani@outlook.com

ORCID: https://orcid.org/0009-0005-9794-7739

Explor Digit Health Technol. 2026;4:101182 DOI: https://doi.org/10.37349/edht.2026.101182

Received: August 21, 2025 Accepted: November 24, 2025 Published: January 19, 2026

Academic Editor: Andy Wai Kan Yeung, The University of Hong Kong, China

Background: To synthesize evidence on how medical thermography, integrated with artificial intelligence (AI), blockchain, 5G (5th Generation mobile networks), and Internet of Things (IoT), enhances diagnostics, fraud prevention, and personalized health insurance in emerging markets, addressing cost escalation and access gaps.

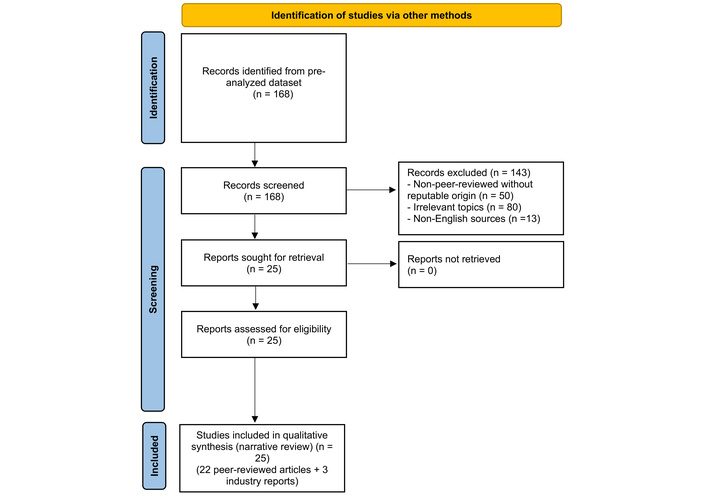

Methods: This systematic review followed AMSTAR 2 and PRISMA guidelines, synthesizing 25 sources (22 peer-reviewed articles, 3 industry reports) from a pre-analyzed dataset. Inclusion focused on relevance to thermography, insurance, or synergistic technologies; exclusions included non-peer-reviewed or irrelevant items. Data extraction via Microsoft Excel (version 2409) covered diagnostics, applications, synergies, and contexts. Quality appraisal used the Mixed Methods Appraisal Tool (MMAT) to assess methodological rigor. Narrative synthesis addressed heterogeneity, without meta-analysis due to design diversity and resource limits.

Results: Thermography achieves 83–98% sensitivities for breast cancer (asymmetries > 3.0°C), diabetic foot ulcers (DFUs; 96.71% with AI), and rheumatoid arthritis (RA; inflammation > 0.5°C), reducing triage times by 25% and costs by 30% in mobile settings. Blockchain’s six-layer architecture, with Practical Byzantine Fault Tolerance and InterPlanetary File System, secures data at US$0.028 per transaction, potentially reducing fraud through enhanced verification. In emerging markets like India and Brazil, portable thermography with 5G supports screening, aligned with standards like T/ZADT 005-2002.

Discussion: These integrations enable early detection (saving US$8,000–12,000 per DFU), fraud mitigation, and equitable access, though protocol variances and biases require attention. Recommendations include standardization, pilots in rural areas, and bias-mitigating AI frameworks to optimize health insurance outcomes.

The global health insurance market, valued at US$2.2 trillion in 2024, as supported by foundational studies on thermography and related technologies [1–16], faces escalating costs from chronic diseases and fraud, with annual losses of US$105–120 billion in the US and Indian Rupees (Rs.) 6–8 billion (US$72–96 million) in India (15% of claims) [2, 17]. In the US, fraud inflates premiums by about US$900 per policyholder [2]; in India, deceptive claims contribute significantly to operational burdens [17]. Similar challenges affect Latin America, where Brazil’s private sector covers 50 million people amid needs for advanced monitoring of fracture healing through infrared thermography [18] and blockchain-enabled value co-creation in healthcare [19], and Asia, including Indonesia, amid rising chronic disease expenditures [17, 20]. Common fraud types—phantom billing (charges for unrendered services), upcoding (exaggerated procedure costs), and identity theft—erode trust and increase costs [2, 17].

Emerging technologies offer solutions for anti-fraud, data security, and risk assessment [2, 3, 16, 19]. Blockchain provides distributed ledgers for secure claims and electronic medical records (EMRs), using Proof of Stake (PoS) for validator reliability [2, 3, 17]. Artificial intelligence (AI) enables advanced diagnostics and continuous monitoring, 5th Generation mobile networks (5G) support low-latency telemedicine, and the Internet of Things (IoT) delivers real-time data streams [3, 7, 19].

Medical thermography, a non-invasive infrared technique mapping skin temperature variations to detect inflammation or blood flow irregularities, integrates with these technologies, supported by critical appraisal tools for systematic reviews [21], applications in sports medicine [22], and insights from global insurance market outlooks [23], to diagnose conditions like rheumatoid arthritis (RA) [24], diabetic foot ulcers (DFUs) [7, 12], breast cancer [6], fever [6], orthopedic injuries [9, 15, 18, 22], wound healing [15, 22], stroke [14], and skin cancer [25], with sensitivities of 83–98% [6, 7, 12]. Chronic diseases impose a global burden: Diabetes affects 463 million, with DFU costs at US$8,000–12,000 per episode and amputations at US$30,000–50,000 [10]; RA impacts 0.5–1% of the population with annual costs that can be reduced by US$10,000–30,000 through early detection [24]. Devices cost under US$500 for DFU applications, higher for breast cancer detection [6, 7, 10].

Thermography highlights imbalances (e.g., inflammation > 0.5°C in RA/DFUs), aiding claim verification, fraud detection, and cost reduction via early intervention [7, 12, 24]. It supports prevention of DFU amputations, refining risk pricing in value-based insurance models, which prioritize preventive care to lower premiums [7, 10, 23]. In emerging economies—hosting 80% of diabetics (24 million in Africa, 77 million in India, 16 million in Brazil)—it bridges coverage gaps despite protocol inconsistencies (e.g., ambient temperature controls) and limited 5G infrastructure [3, 6, 7, 20]. Temperature differences (29.7 ± 2.9°C in diabetic feet vs. 26.7 ± 1.6°C in healthy ones) enable cost-effective diagnostics [7].

This review, drawing on 25 sources, examines thermography’s role in insurance, focusing on risk evaluation, fraud deterrence, tailored offerings, technological synergies, and opportunities in emerging markets [2, 3, 5–7, 10, 12, 16, 17, 19–21, 23]. It incorporates blockchain’s layered designs [3] and AI’s diagnostic sensitivities [7] to address US$120 billion annual US fraud losses [2, 17].

To frame these integrations theoretically, this review adopts the technology-organization-environment (TOE) framework, a model assessing technology adoption through technological innovation (e.g., AI’s diagnostic accuracy, blockchain’s security), organizational readiness (e.g., insurer infrastructure for mobile diagnostics), and environmental factors (e.g., regulatory standards in emerging markets), as inspired by studies on technology integration in healthcare and insurance [3, 6, 7, 15, 19, 20, 25]. This framework unifies the analysis of how thermography and synergistic technologies enhance insurance efficiency, providing a structured lens to examine adoption drivers and barriers across diverse contexts.

This systematic review evaluates medical thermography’s insurance role, guided by AMSTAR 2 for rigorous criteria and limitation acknowledgment [21]. Conducted by a single researcher, it prioritizes practicality with predefined protocols to minimize bias.

From a pre-analyzed dataset of 168 sources retrieved from PubMed, Scopus, Google Scholar, and Google on thermography, insurance, AI, blockchain, 5G, and IoT [2, 3, 5–7, 9–20, 22–25], inclusion criteria targeted relevance, peer-reviewed status or credible industry reports, and insurance applicability (e.g., risk assessment, fraud prevention) [2, 6]. Manual screening of titles/abstracts for keywords like “thermography” or “blockchain,” followed by full-text review, yielded 25 sources. Exclusions: non-peer-reviewed without strong backing, non-insurance scopes (e.g., veterinary), non-English [2, 6]. The selection process was aligned with AMSTAR 2 [21]. See Figure 1 for the PRISMA flow diagram.

PRISMA flow diagram for study selection. Adapted from “PRISMA” (http://www.prisma-statement.org/). Accessed October 15, 2025. © 2024–2025 the PRISMA Executive. Distributed under a Creative Commons Attribution (CC BY 4.0) license.

Manual extraction via Microsoft Excel (version 2409), a spreadsheet tool for organizing and categorizing data, recorded applications (e.g., diagnostic sensitivities), insurance functions (e.g., fraud metrics), integrations [e.g., AI convolutional neural networks (CNNs)], and contexts (e.g., emerging market infrastructure hurdles) [2, 6, 7, 12]. Quantitative data (e.g., 83–98% sensitivities [6, 7, 12], annual US fraud losses exceeding US$100 billion [2], US$0.028 transaction fees [2]) and qualitative insights (e.g., blockchain’s tamper-proofing [2], thermography’s rural fit [6]) were categorized. Examples: Khandakar et al. (2021) [7] on DFU sensitivity; Russo-Spena et al. (2023) [19] on blockchain value co-creation.

Heterogeneous designs (reviews, experiments, proposals, reports [2, 6, 19]) necessitated narrative synthesis with thematic analysis, grouping by diagnostics, applications, synergies, and contexts. No meta-analysis due to varied outcomes (e.g., sensitivity vs. fraud reduction) and resource limits; subgroup exploration (e.g., by disease like DFUs or technology like blockchain) informed themes. Quality appraised via the Mixed Methods Appraisal Tool (MMAT), a checklist for evaluating methodological rigor across qualitative, quantitative, and mixed-method studies, assessing design appropriateness, data collection clarity, and integration coherence; most sources scored high (4–5/5) for rigor, though some industry reports lacked full methodological detail [21].

To provide focused insights into individual contributions, as suggested by reviewers, this subsection summarizes key studies central to the review’s themes, ensuring clarity on their empirical and theoretical roles without redundancy:

Khandakar et al. (2021) [7]: Developed a machine learning model using CNNs, which automatically extracts image features like temperature gradients, for early DFU detection via thermogram images, achieving 96.71% sensitivity and highlighting deviations (29.7 ± 2.9°C in diabetic feet vs. 26.7 ± 1.6°C in healthy ones), emphasizing AI’s role in cost-effective mobile diagnostics.

Russo-Spena et al. (2023) [19]: Explored blockchain’s potential for value co-creation in healthcare, enabling collaborative fraud prevention through transparent claim processing and integration with 5G for telemedicine, underscoring benefits for insurers and providers in distributed networks.

Chen et al. (2025) [3]: Provided guidelines for medical blockchain, detailing six-layer architectures (data, network, incentive, consensus, contract, application) with tools like Practical Byzantine Fault Tolerance (PBFT) for reliable consensus and InterPlanetary File System (IPFS) for decentralized storage, applied to secure EMRs and reduce transaction costs.

Kesztyüs et al. (2023) [6]: Conducted a scoping review on infrared thermography (IRT)’s applications in diagnostics and screening, reporting 83–98% sensitivities for conditions like breast cancer and DFUs, advocating standardization to address protocol variances (e.g., ambient temperature controls).

Amin et al. (2024) [2]: Proposed blockchain and smart contracts for health insurance fraud prevention, using multi-signature processes requiring multiple cryptographic approvals at US$0.028 per transaction to cut losses through efficient fraud prevention using multi-signature processes, with applications in cashless claims.

Kurkela et al. (2023) [10]: Analyzed costs of thermography versus standard care for DFU prevention, using real-world data to demonstrate 30% cost reductions and savings of US$8,000–12,000 per episode, supporting its actuarial value for insurance risk pricing.

Magalhaes et al. (2021) [11]: Performed a meta-analysis on machine learning classifiers in thermography, reporting 89–94% sensitivities for diabetes-related conditions, highlighting AI’s scalability for automated risk assessment in insurance.

Rana et al. (2022) [16]: Proposed a blockchain-AI model for healthcare interoperability, emphasizing decentralized access control to enhance claim verification, with implications for reducing fraud in insurance systems.

Schanz (2019) [20]: Explored protection gaps in emerging markets’ healthcare, noting diabetes burdens (e.g., 77 million in India) and how technologies like thermography can bridge coverage through public-private partnerships, increasing access by 15%.

Tan et al. (2021) [24]: Demonstrated combined thermography-ultrasound for RA inflammation detection (> 0.5°C), achieving 15% precision boost, with annual cost reductions (US$10,000–30,000) relevant to insurance underwriting models.

Single researcher risks selection/extraction bias, mitigated by predefined criteria and transparent reporting; 25-source focus may miss literature; heterogeneity precluded quantitative synthesis; MMAT appraisal strengthens reliability despite no formal inter-rater checks, as it evaluates study design, data quality, and integration systematically [21]. Future reviews could incorporate dual-reviewer coding for enhanced validity. No external searches or software beyond Excel (version 2409).

IRT detects temperature variations for chronic, oncological, and musculoskeletal conditions like RA [24], DFUs [7, 12], breast cancer [6], orthopedic injuries [9, 15, 18, 22], wound healing [15, 22], stroke [14], and skin cancer [1, 6, 7, 11–13, 24, 25]. It offers better performance in dense breasts where mammography sensitivity drops to 50% or less [6], with a mean thermography sensitivity of 83% for breast cancer detection (> 3.0°C asymmetries), 89–94% AI-enhanced for diabetes, and 98% for DFUs via machine learning [6, 7, 11]. Portable devices reduce triage times by 25% and costs by 30%; AI-driven CNNs yield 96.71% accuracy, identifying 29.7 ± 2.9°C in diabetic feet vs. 26.7 ± 1.6°C in healthy ones [7, 12, 13]. Pairing with ultrasonography boosts RA precision by 15% (> 0.5°C inflammation) [24]; wound monitoring enables early detection of complications, predicting issues 35–41 days in advance [15]. Specialized uses include stroke detection via facial asymmetry [14], skin cancer evaluation through subtle temperature shifts [25], and pre-surgical assessments in military settings [8]. Inconsistent protocols (e.g., ambient controls, imaging angles) necessitate standardization [6]. Valuable in emerging markets for non-invasive screening [6, 7]. Blockchain secures EMRs via IPFS and smart contracts for remote sharing [3]. These diagnostic sensitivities are summarized in Table 1, highlighting variations due to protocols and equipment.

Summary of thermography diagnostic sensitivities from key studies.

| Condition | Sensitivity range (%) | Key metrics/Examples | References |

|---|---|---|---|

| Breast cancer | 83–98 | Thermal asymmetry > 3.0°C | [6, 11] |

| Diabetic foot ulcers (DFUs) | 89–98 | 96.71% with AI; temperatures 29.7 ± 2.9°C diabetic vs. 26.7 ± 1.6°C healthy | [7, 12] |

| Rheumatoid arthritis (RA) | N/A (no direct sensitivity reported) | Combined with ultrasound shows superior correlation with DAS28 [e.g., r = 0.393 for MAX (PD), p-value = 0.016] | [24] |

| Orthopedic injuries/Wounds | Up to 98 | Fracture tracking and healing monitoring | [9, 15, 18, 22] |

| Other (e.g., stroke, skin cancer) | N/A (no direct sensitivity reported) | Facial asymmetry for stroke (e.g., > 0.5°C abnormal; specific sensitivities 33–56% for Wallenberg syndrome); subtle temperature differences for skin cancer (e.g., Δ 2–4 K for melanoma) | [14, 25] |

Ranges reflect variations due to protocols and equipment; all p-values < 0.05 were reported [6, 7, 12]. For RA and other conditions, focus is on correlation and qualitative metrics rather than direct sensitivity, with significant associations (e.g., p < 0.05) as per [14, 24, 25]. AI: artificial intelligence; DAS28: Disease Activity Score 28, a validated index for RA disease activity discussed in the main text.

Thermography supports risk assessment, fraud prevention, and actuarial modeling. Early DFU detection lowers costs, avoiding costly amputations [7, 10]; enhances breast cancer screening, reducing long-term costs [6]; and eases RA expenses through early identification of inflammation > 0.5°C [24]. Blockchain significantly reduces fraud with automated verification [2, 3, 17]. Accurate thermography data enables customized pricing, boosting policyholder engagement by 15% through wellness programs linked to compliance, aligning with value-based insurance models that reduce premiums via preventive care [5, 6, 10, 20, 23]. For instance, DFU screening can yield notable cost savings by preventing high-cost interventions, while RA early detection optimizes risk assessment through better inflammation detection [7, 10, 24]. These models promote equity by channeling savings into lower premiums, particularly in emerging markets where cost barriers limit access [20, 23]. Multi-signature processes, requiring cryptographic approvals, operate at US$0.028 per transaction; PoS supports cashless claims, tackling the 15% fraud burden on Indian claims—predominantly through deceptive practices like upcoding and phantom billing, totaling Rs. 6–8 billion yearly (about US$72–96 million)—to streamline cashless processing [17]. In emerging markets, thermography links hospitals, insurers, and patients to eliminate redundant tests, optimizing expenses [3].

Thermography synergizes with these technologies to drive operational efficiency and scalability. AI enhances diagnostics, reducing false positives through CNNs that adeptly extract features such as edges and textures from thermal images [7, 11–13]. Blockchain bolsters claim verification through enhanced processes, leveraging a robust six-layer architecture (data, network, incentive, consensus, contract, application) underpinned by PBFT for consensus reliability and IPFS for decentralized storage [3, 16]. Complementing this, 5G enables low-latency telemedicine [3, 7, 19], while IoT wearables deliver continuous monitoring [15], with blockchain enabling privacy-preserving ecosystems for secure real-time data sharing [3]. Ethical imperatives, including GDPR (General Data Protection Regulation)-compliant encryption for IoT streams and debiased AI algorithms, remain paramount to mitigate risks [3, 4, 19]. The integration of these elements—particularly the fusion of CNNs for thermal pattern analysis with blockchain for secure data management—yields a resilient framework for dynamic data processing [3, 13]. Table 2 synthesizes these synergies, delineating their contributions to enhanced diagnostics and fraud mitigation.

Synergies of technologies with thermography.

| Technology | Diagnostic enhancement | Fraud prevention | Key features | References |

|---|---|---|---|---|

| AI | Enhanced processing, reduced false positives via CNN feature extraction | Automated risk assessment in claims | Edge/texture analysis from images | [7, 11–13] |

| Blockchain | Secure thermal image storage and sharing | Enhanced verification, tamper-resistant records | Six-layer architecture, PBFT consensus, IPFS off-chain storage | [3, 16] |

| 5G | Low-latency telemedicine for remote diagnostics | Real-time data validation | Support for high-density connections | [3, 7, 19] |

| IoT | Continuous monitoring for proactive care | Secure data exchange for tracking | Integration with blockchain for data management | [3, 15] |

AI: artificial intelligence; CNN: convolutional neural network; PBFT: Practical Byzantine Fault Tolerance; IPFS: InterPlanetary File System; 5G: 5th Generation mobile networks; IoT: Internet of Things.

Portable thermography in mobile clinics expands chronic disease screening, with public-private partnerships increasing coverage by 15% in diabetes-heavy regions like Africa (24 million diabetics) and India (77 million) [6, 7, 20]. Blockchain supports the reduction of drug counterfeiting risks via standards like Technical Standard for Blockchain in Medical Data Management (T/ZADT 005-2002), fortifying secure supply chains in regions plagued by substandard medications that exacerbate chronic disease burdens [2, 3, 17, 20]. IoT supports real-time monitoring in rural areas [19, 20]. Challenges include limited 5G infrastructure and regulatory hurdles, such as inconsistent data privacy laws in India and Brazil, raising rollout costs; solutions involve low-fee blockchain, phased 5G expansion, and community education [3, 6, 19, 20]. Amid Brazil’s private health insurance sector, which safeguards 50 million individuals against chronic disease burdens [20], blockchain protocols akin to T/ZADT 005-2002—emphasizing decentralized data management for EMRs—promote interoperable fraud defenses by enabling tamper-evident claim audits across provider-insurer ecosystems [3, 17].

Thermography’s early detection (e.g., 83% sensitivity for breast cancer with > 3.0°C asymmetries [6], 96.71% AI-enhanced for DFUs at 29.7 ± 2.9°C [7, 12], > 0.5°C inflammation for RA [24]) reduces costs: reducing DFU/amputation expenses (US$8,000–50,000) [7, 10], easing RA biologic costs (US$10,000–30,000) [24], limiting late-stage cancer outlays [6]. It enables proactive monitoring and lifestyle interventions, aligning with global cost-control trends [5, 23]. US DFU screening could lower claims, yielding notable cost savings [10]. Blockchain’s multi-signature and PoS take mechanisms, at US$0.028 per transaction, combat fraud (e.g., phantom billing, upcoding), enhancing trust and transparency among stakeholders [17], freeing resources for competitive pricing [23]. Thermography supports precise underwriting for high-risk conditions like DFUs (with notable amputation risk) and RA, enabling tailored premiums tied to compliance with preventive measures, such as regular screenings or lifestyle programs [6, 7, 24]. For instance, in value-based insurance models, early DFU detection can generate notable cost savings by avoiding costly interventions, while RA screening optimizes long-term expense management, promoting equity by channeling savings into lower premiums, particularly in emerging markets where cost barriers limit access [5, 10, 20, 23]. These advancements align with value-based insurance, reducing long-term claims across developed and emerging landscapes [5].

Building on results, these integrations imply scalable, equitable insurance systems. AI’s efficiency reduces human error but requires bias mitigation for fair outcomes [3, 4, 19]. Blockchain’s six-layer architecture ensures robust security, yet demands interoperability standards [3, 16]. 5G and IoT enable proactive care models, but ethical safeguards like privacy-preserving encryption are critical to prevent privacy risks [3]. Applying the TOE framework, technological factors like AI’s 96.71% DFU sensitivity [7] and blockchain’s PBFT consensus [3] drive diagnostic accuracy, while organizational elements—such as insurer adoption of portable thermography devices for mobile clinics [6, 7]—require infrastructure investments to manage data streams from monitoring applications [15, 25]. Environmental contexts, including regulatory standards like T/ZADT 005-2002 in emerging markets [3], shape rollout feasibility. For example, limited 5G infrastructure may delay telemedicine benefits in rural India, necessitating phased implementation and training for insurers to integrate AI-driven diagnostics [19, 20]. TOE’s structured approach enhances insurance applications by predicting higher efficiency when organizational readiness (e.g., insurer capacity for blockchain adoption) aligns with technological maturity (e.g., low-cost transactions at US$0.028 [2, 17]), but barriers like inconsistent thermography protocols (e.g., uncontrolled ambient temperatures [6]) highlight the need for environmental adaptations to ensure equitable adoption across diverse markets [20].

Opportunities include 15% coverage expansion via mobile thermography in diabetes-heavy regions like Africa (24 million diabetics), India (77 million), and Brazil (16 million) [6, 7, 20], pivotal for blockchain’s role in trimming counterfeit drug proliferation, a menace that siphons substantial resources globally each year and heightens vulnerabilities in diabetes-prone emerging economies [3, 20]. However, barriers persist: limited 5G infrastructure and regulatory hurdles, such as inconsistent data privacy laws in India and Brazil, raising rollout costs, constrain telemedicine access [3, 19, 20]. Thermography protocol variances (e.g., ambient temperature controls, imaging angles) exacerbate inconsistencies in low-resource settings [6]. Blockchain’s theoretical applications, despite > 80% expert consensus, require real-world insurance trials to validate potential fraud reductions [2, 17]. Evidence limitations include only 51% of thermography studies reporting precise metrics, with sensitivities varying from 25–98% due to protocol differences [6]. Blockchain’s benefits, such as alleviating the entrenched 15% fraud in Indian insurance claims, where deceptive tactics inflate costs by Rs. 6–8 billion (US$72–96 million) annually, thereby enabling more equitable risk pooling under value-based models [2, 17, 23], rely on theoretical models, needing direct studies in markets like Nigeria or Brazil to confirm inferred benefits [2, 17, 20]. For example, India’s fraud challenges demand blockchain-driven cashless claims for efficient audits, but 5G gaps limit rural triage, requiring phased rollout and community education [17, 19]. In Brazil, where private coverage extends to 50 million amid diabetes prevalence rates mirroring global emerging trends [20], adopting blockchain benchmarks such as T/ZADT 005-2002 could streamline hospital-insurer collaborations for secure transaction validation, though empirical pilots remain scarce to substantiate these interoperability gains [3, 17]. Varied study designs necessitate standardized outcomes and real-world PBFT testing to ensure equitable scaling [6, 12, 19].

Ethical considerations are critical for sustainable technology adoption in insurance. AI algorithms in thermography, such as CNNs for DFU detection [7, 12], must ensure fairness to avoid biases that could disproportionately impact emerging market populations with limited data diversity, potentially exacerbating access gaps [3, 4, 19]. Blockchain and IoT integrations require privacy-preserving encryption to safeguard patient data privacy, as extensive data collection from wearables risks unauthorized access without secure storage via IPFS or smart contracts [3]. Multi-signature processes enhance transparency in claim verification but raise data sovereignty concerns in regions with diverse regulatory frameworks, such as India or Brazil [2, 17, 20]. Value co-creation models, where stakeholders collaborate for mutual benefit, must prioritize informed consent and equitable benefit sharing to build trust, particularly in low-resource settings [19]. Standardized guidelines, such as those for blockchain [3] or thermography protocols [6], ensure that technological synergies promote inclusivity without compromising ethical standards.

Thermography transforms insurance via timely diagnosis of breast cancer [6], DFUs [7, 12], and RA [24], with high sensitivities [6, 7, 12, 24]. Integrated with AI [7, 12], blockchain [2, 17], 5G [3, 19], and IoT—enabling continuous monitoring via wearables [3, 15], it mitigates fraud [2, 17], expands emerging market screening [20], and cuts costs via mobile units [6]. Insurers should pilot blockchain for notable trust and audit savings [17] and thermography for preventive cost savings [10]. Policymakers should foster public-private partnerships for notable uptake [20] and adopt International Academy of Clinical Thermology standards [6]. Providers should leverage AI-enhanced thermography and 5G for rural access [3, 19]. Researchers must validate blockchain’s insurance impacts [2, 17], assess 5G expansion [3], and establish global norms for equity [20], with AI wearables streamlining risk evaluations [3, 12].

5G: 5th Generation mobile networks

AI: artificial intelligence

CNNs: convolutional neural networks

DFUs: diabetic foot ulcers

EMRs: electronic medical records

GDPR: General Data Protection Regulation

IoT: Internet of Things

IPFS: InterPlanetary File System

IRT: infrared thermography

MMAT: Mixed Methods Appraisal Tool

PBFT: Practical Byzantine Fault Tolerance

PoS: Proof of Stake

RA: rheumatoid arthritis

Rs.: Indian Rupees

T/ZADT 005-2002: Technical Standard for Blockchain in Medical Data Management

TOE: technology-organization-environment

This research was conducted as part of the Postgraduate Program in Insurance Medicine at the Faculty of Medicine, University of Porto.

EMF: Conceptualization, Methodology, Investigation, Writing—original draft, Writing—review & editing. The author read and approved the submitted version.

The author declares that there are no conflicts of interest.

Not applicable.

Not applicable.

Not applicable.

All data are included in this article; sources are publicly available via references. For further discussion regarding this perspective, please contact the corresponding author.

No external funding.

© The Author(s) 2026.

Open Exploration maintains a neutral stance on jurisdictional claims in published institutional affiliations and maps. All opinions expressed in this article are the personal views of the author(s) and do not represent the stance of the editorial team or the publisher.

Copyright: © The Author(s) 2026. This is an Open Access article licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, sharing, adaptation, distribution and reproduction in any medium or format, for any purpose, even commercially, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

View: 511

Download: 26

Times Cited: 0